- December 1, 2025

- Posted by: Deepak

- Category: Employee Wellness

Experience this blog through our audio narration.

In today’s fast-paced and often demanding work environment, employees face a wide range of personal and professional challenges. Stress, mental health concerns, family responsibilities, financial pressures, and significant life changes can all affect an individual’s well-being and job performance. When these issues go unaddressed, they can impact productivity, morale, and overall workplace culture.

This is where an Employee and Family Assistance Program (EFAP) plays a critical role. As a core component of many group benefi ts plans in Canada, EFAP provides confi dential, professional support to employees and their families when they need it most. This guide explains what this plan is, how it works, who

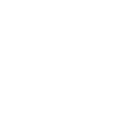

What Is an Employee and Family Assistance Program (EAP)?

An Employee and Family Assistance Program (EFAP), sometimes referred to as an Employee Assistance Program (EAP), is a workplace benefit designed to help employees manage personal or work-related challenges. EAP offers confidential counseling, information, and referral services that support mental health, emotional well-being, and everyday life concerns.

EAP acts as a reliable support system that employees can access 24/7. Through this program, individuals can connect with trained professionals who help them make informed decisions and move forward with confidence. Furthermore, these services are confidential and separate from the employer.1

Services Typically Included in EAP

One of the greatest strengths of EAP is the breadth of services it offers. While programs vary by provider, most EAPs include the following areas of support.2

- Mental Health and Emotional Support Employees can access confidential counseling for concerns such as stress, anxiety, depression, burnout, and grief. Short-term counseling sessions are usually provided by licensed professionals, along with access to self-help tools and wellness resources.2

- Financial and Legal Assistance Many EAPs offer financial counseling to help with budgeting, debt management, and financial planning. Legal support may include consultations related to divorce, wills, estate planning, tenant issues, or real estate questions.2

- Work-Life and Career Support Employees may access career counseling, retirement planning guidance, and resources for managing work-related stress. EAP also often provides referrals for childcare and eldercare support.2

- Health and Lifestyle Resources Some programs include guidance on nutrition, smoking cessation,

Who Is Eligible for EAP?

Coverage typically extends beyond the employee to include immediate family members. Eligibility usually includes:

● Spouses or common-law partners

● Dependent children (often up to age 21 or 26)

● In some cases, dependent parents or household members

Many employers also allow access during leaves of absence, disability, or employment transitions, reinforcing EAP as a supportive resource throughout the employee lifecycle.4

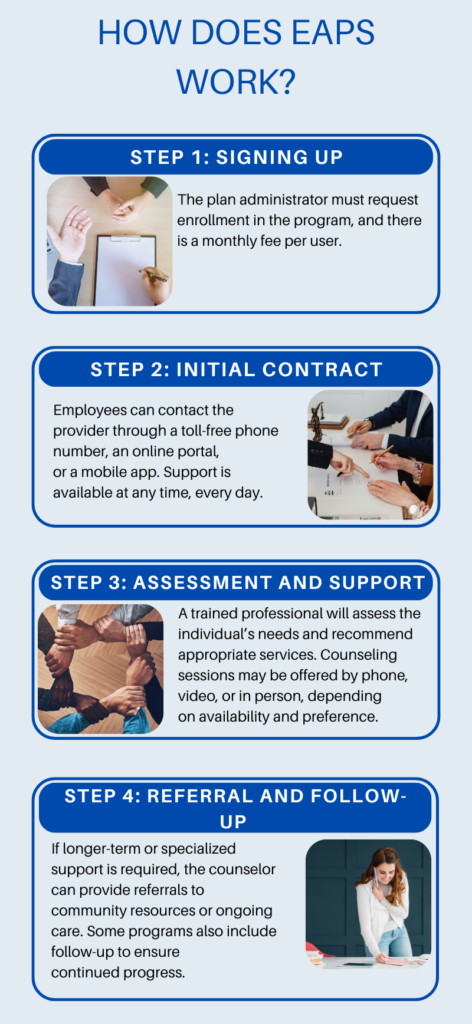

Tax Treatment of EAP Under CRA Guidelines

From a tax standpoint, the Canada Revenue Agency (CRA) generally considers EAPs to be non-taxable benefits. This is because the coverage is viewed as primarily benefiting the employer by supporting employee well-being, productivity, and overall workplace effectiveness, rather than providing a direct financial gain to the employee.5

As a result, the cost of EAP coverage is not included in employees’ taxable income and does not need to be reported on T4 slips. This makes the benefit a highly tax-efficient way for employers to invest in workforce wellness.5

Employers should be aware that exceptions may apply if an EAP includes services that offer a direct personal financial benefit unrelated to employment, such as individualized investment advice or tax preparation. In most standard arrangements, however, employer-paid coverage remains non-taxable under current CRA guidance.5

Why EAP Matters

For employers, EAP delivers meaningful value. By supporting employees early, organizations often see improved productivity, reduced absenteeism, stronger retention, and a healthier workplace culture. For employees, EAP provides accessible, professional help, without financial barriers or stigma.1

Furthermore, confidentiality is a cornerstone of this benefit. All interactions with counselors are private and protected by professional and legal standards. Employers do not receive individual usage details, which helps employees feel safe seeking support.1

Final Thoughts

An Employee Assistance Program (EAP) is an essential part of modern group benefits, demonstrating to employees that their employer is invested in their long-term health, stability, and success – both inside and outside of work. When positioned effectively, EAP reinforces a culture of care and supports a healthier, more resilient workforce.1

However, many employers face a common challenge: low utilization due to limited awareness. Employees often don’t fully understand what EAP includes, who is eligible, or how easy it is to access services. Without consistent communication and education, this valuable benefit can remain underused, limiting its impact on employee well-being and organizational outcomes.1

When EAP is actively promoted and clearly communicated, employees are more likely to view it as a trusted, confidential resource for ongoing support. Increased awareness translates into higher utilization, improved employee well-being, and greater value from the employer’s investment.1 If you have any further questions about our group benefits programs, please don’t hesitate to contact us.

Citations

1.2025 Group Benefits Providers Report: A look at the different benefits plan models available to Canadian employers, Benefits Canada

https://www.benefitscanada.com/archives_/benefits-canada-archive/2025-group-benefits-providers-report-a-look-at-the-different-benefits-plan-models-available-to-canadian-employers/

2. Public Service Group Insurance Benefit Plans – Canada.ca.

https://www.canada.ca/en/treasury-board-secretariat/topics/benefit-plans.html

3. Life Events: Public service group insurance benefit plans, Government of Canada

https://www.canada.ca/en/treasury-board-secretariat/services/benefit-plans/life-events.html

4. The Public Service Management Insurance Plan – Main plan booklet, Government of Canada.

https://www.canada.ca/en/treasury-board-secretariat/services/benefit-plans/management-insurance-plan/main-plan-booklet.html

5. A guide to the coordination of benefits, McGill University

https://www.mcgill.ca/hr/files/hr/brochure_guide_to_coordinationbenefits_eng1.pdf

Share Us

WE WOULD APPRECIATE YOUR FEEDBACK FOR THIS BLOG!

Help us serve you better. If you found this blog insightful, take a moment to rate it—it helps us continue creating content you care about!

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Talk to your Benefits Advisor

403-903-2898

587-430-0516

Call us if you have any further questions .

1925 18 Ave NE #115,

Calgary, AB T2E 7T8

Email: info@wescaninsurance.ca