- August 23, 2025

- Posted by: Deepak

- Category: Group Benefits

Understanding Plan Member Benefits Eligibility in Canada

Experience this blog through our audio narration.

In today’s competitive job market, comprehensive employee benefits are essential for attracting and retaining top talent. For employees in Canada1, access to group benefits plans can provide critical financial and healthcare support. However, not everyone automatically qualifies for these benefits. Understanding who is eligible, how the system works, and the factors involved is essential for both employers and employees.

Who Is a Plan Member?

A plan member refers to an employee who qualifies for and is enrolled in a group benefits plan through their workplace. Eligibility isn’t automatic, though – it depends on meeting specific criteria outlined by the employer and insurer, such as2:

Some plans require that the employee work a certain number of hours per week to be eligible.

Each province administers its own health care plan with specific eligibility criteria, so it’s essential to review the requirements based on where you live or plan to reside.

Most plans include a waiting period before new employees can join.

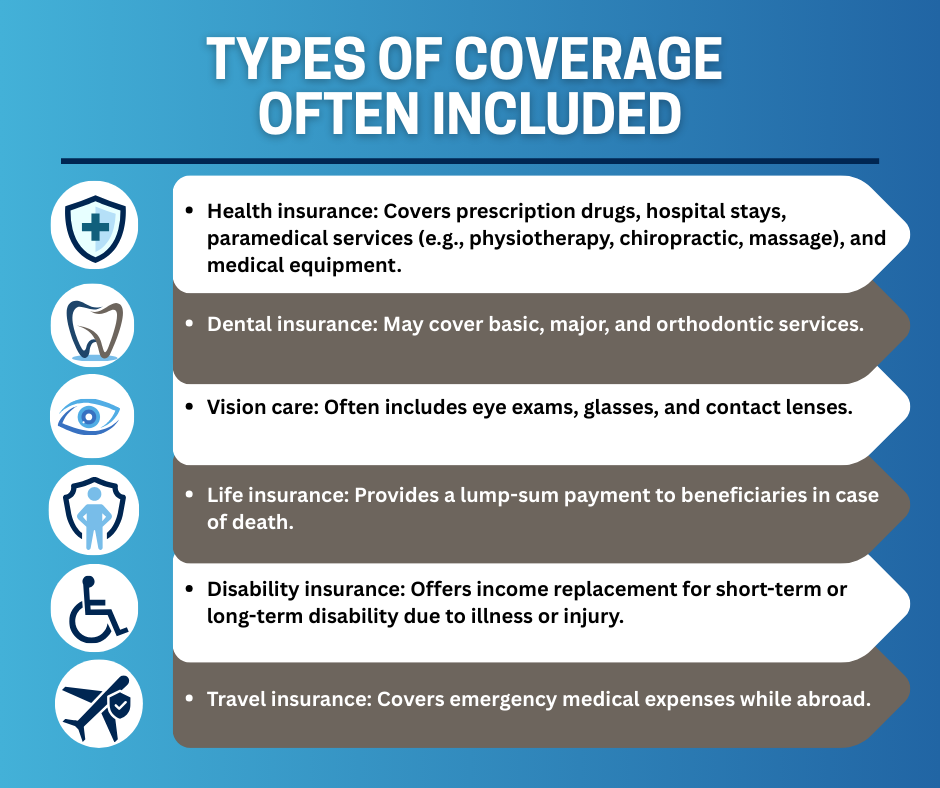

Being a plan member means having access to various types of insurance, such as health, dental, vision, life, and disability coverage, depending on the plan.

Who Are Dependents?

A plan member’s dependents may also be eligible for coverage under the group plan. Dependents typically include3:

- Spouses or Common-law partners

- Children under a certain age - usually 21, or up to 25 if they are full-time students

- Disabled dependents - if they meet the criteria defined by the insurer, they may be eligible for continued coverage beyond the age limit

It’s crucial to accurately report dependent status during enrollment, as misreporting can lead to delays or denials in claims.

Why a Waiting Period Helps Employers

Employers often set a waiting period, typically between 3 and 6 months, before new hires become eligible for benefits. This serves several essential functions:

Limits frequent plan updates due to high employee turnover.

Discourages individuals from joining a company solely for short-term benefits.

Gives time to assess whether a new hire is likely to remain with the organization long-term.

While it may feel like a delay to new employees, a waiting period is a protective measure for the sustainability of the plan.

Evidence of Insurability (EOI)

What Is It and When Is It Needed?

Evidence of Insurability (EOI) is a process by which an employee or dependent provides medical information to an insurance company to determine if they qualify for certain types of coverage.

EOI is usually required when4:

- The individual elects optional life insurance coverage

- A plan member enrolls after the initial eligibility period.

- A dependent is being added after the standard window of time.

- The group insured is small

Benefits of EOI in a Group Plan

While it can feel like a hurdle, EOI has several benefits in the context of group insurance:

- Maintains plan affordability: Keeps premiums stable by reducing high-risk claims.

- Allows flexibility: Members can apply for increased coverage when life circumstances change (e.g., marriage, birth of a child).

Claims and Coverage

What Plan Members Need to Know

Once enrolled, plan members can begin using their benefits; however, it’s essential to understand how claims work and what is covered.

Each category comes with maximums, co-pays, deductibles, and exclusions, so members should carefully review their plan booklets or online portals.

Other Important Considerations

Coordination of Benefits (COB)

Termination of Coverage

Coverage can end due to:

- Leaving the employer

- Retirement (unless a retiree plan is offered)

- Non-payment of premiums (in cost-shared plans)

- Death of the plan member (for dependents)

Members may be offered conversion options, such as converting a life insurance policy to an individual policy, under specific situations.

Reinstatement and Re-enrollment

Employees who leave and return may be required to complete another waiting period or provide additional Evidence of Insurability. However, some plans allow for automatic reinstatement, depending on the terms and conditions of your plan. Many insurance carriers also allow plan members who previously left a group benefits plan to have their coverage reinstated if they return to work and re-enroll within six months of leaving.

CONCLUSION

Understanding plan member eligibility in Canada is essential to maximizing the value of a group benefits plan. Knowing who qualifies, how dependents are covered, and the role of waiting periods and evidence of insurability helps both employees and employers make the most of their benefits.

One of the key advantages of group benefits is the ability to access coverage without undergoing medical underwriting. This means that individuals who might otherwise be declined for personal insurance due to pre-existing conditions can secure valuable protection simply by enrolling during the standard eligibility window1.

Staying informed empowers plan members to make confident decisions about their health and financial security. If you’d like to learn more or discuss your specific situation, our benefits advisors are here to help – contact us today to get started.

Citations

1. 2025 Group Benefits Providers Report: A look at the different benefits plan models available to Canadian employers, Benefits Canada

2. 7 Factors that affect group insurance eligibility and coverage, Benefits by Design

3. Life Events: Public service group insurance benefit plans, Government of Canada

4. What is Evidence of Insurability (EOI)?

5. A guide to the coordination of benefits, McGill University

Share Us

WE WOULD APPRECIATE YOUR FEEDBACK FOR THIS BLOG!

Help us serve you better. If you found this blog insightful, take a moment to rate it—it helps us continue creating content you care about!

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

Talk to your Benefits Advisor

403-903-2898

587-430-0516

Call us if you have any further questions .

1925 18 Ave NE #115,

Calgary, AB T2E 7T8

Email: info@wescaninsurance.ca